The legal challenges confronting Donald Trump have sent shockwaves through his business ventures. In response, some donors and investors are reevaluating their financial commitments, leading to a withdrawal of over $200 million in funds. Nevertheless, Trump and his management team view these losses as an unexpected blessing.

A Strategic Funding Approach

From the outset, the goal was never a direct cash infusion. Instead, Trump Media & Technology Group (TMTG) aimed to merge with a shell company created by Trump himself, known as Digital World Acquisition Corp (DWAC).

The Role of DWAC

DWAC, designed as a Special Purpose Acquisition Company (SPAC), was intended to become the parent company for Trump’s media enterprises following the merger. Additionally, the merger sought to take TMTG public through a stock exchange listing.

Regulatory Changes Take a Toll

While DWAC initially secured $1 billion from institutional investors, recent regulatory changes by the Securities and Exchange Commission (SEC) had a detrimental impact on investments in shell companies like DWAC. Notably, Trump personally incurred a substantial loss of nearly $200 million due to these regulatory changes.

Investors Seek Shelter

With the SEC’s regulatory actions and the growing legal quagmire surrounding Trump, many investors decided to cut their losses. This led to the termination of investments in DWAC, totaling $467 million.

Funds Dwindle

Once the refunded amount is returned to investors, DWAC will be left with just $533 million, significantly short of covering TMTG’s post-merger operational costs. DWAC’s CEO, Eric Swider, made the decision to refund the remaining fund balance to concerned investors.

Merger Plans on Hold

Given these circumstances, it appears that the merger plans will need to be temporarily shelved. One of TMTG’s major concerns is Truth Social, a social media platform now facing a substantial loss of investment.

CEO’s Optimism

Devin Nunes, the CEO of TMTG, has emphasized that the decision to refund the entire $1 billion is in the best interest of the company’s equity holders.

Strategic Decision for Equity Holders

Though a surprising move to many, this decision signals a significant commitment to maintaining the company’s fiscal stability. Nunes has highlighted that this proactive strategy would not only protect shareholders’ interests but also pave the pathway for sustainable growth in forthcoming years.

Analysts’ Apprehension

Nonetheless, the $1 billion loss remains a significant setback in the eyes of most financial analysts and stockbrokers. The term “benefit to equity holders” used by Nunes has left many pundits puzzled.

Uncertain Future

While Nunes didn’t provide further details, he stressed that TMTG remains committed to pursuing the planned merger with DWAC.

Continued Commitments Amidst Uncertainty

In the face of logistical challenges and regulatory scrutiny, the merger’s continuation depends greatly on the attitude of its supporters and stakeholders. Both TMTG and DWAC continue to experience pressure from investors, concerned about potential losses.

Stakeholders’ Uncertainties

Notwithstanding this pressure, there remains strong reliance on the future expectation that this union could indeed revolutionize the media landscape. A doctrine best reflected in the collective thoughts and shared vision of both institutions. As expressed in various discussions and agglomerated consensus, they see a future where their respective strengths can be synergistically leveraged.

Calm Amidst Turmoil

Some financial analysts suggest that Swider and Nunes are attempting to calm their shareholders and mitigate panic’s impact on the business or stock value. This strategy aims to prevent further investment losses.

Shareholder Hope

Both DWAC and TMTG have compelling reasons to maintain shareholders’ hope. Canceling the merger could potentially lead to a sharp drop in DWAC’s stock value.

Conversely, the possible upside for TMTG in persisting with the merger is neither insignificant nor overlooked. The intention to merge unleashed a surge in DWAC’s market value that could prove highly beneficial to TMTG if the merger does proceed.

The variations in DWAC stock prices have undeniably been amplified by news and updates on the merger, rendering the volatility an important aspect of the scenario.

Stock Price Fluctuations

In 2021, DWAC’s shares soared by a staggering 800% shortly after the announcement of the DWAC-TMTG merger. However, in 2022 and early this month, DWAC shares plummeted from $100 to $15.40 per unit.

A Quest for Sustainability

Considering the statements made by Swider and Nunes, the future of Trump Media & Technology Group after the proposed merger remains uncertain. Swider’s statement hints at the desire to establish a sustainable business not overly reliant on capital injections.

Auditing Concerns

Forbes reported earlier this month that DWAC cautioned the public against relying on its unaudited financial statements due to weak internal accounting practices.

Awaiting Developments

Financial experts are closely monitoring the developments surrounding the proposed DWAC-TMTG merger, waiting to see how it unfolds.

“Someone Else Is Running the Country for Him”: President Biden Accidently Reads Out Teleprompter Instructions During Speech

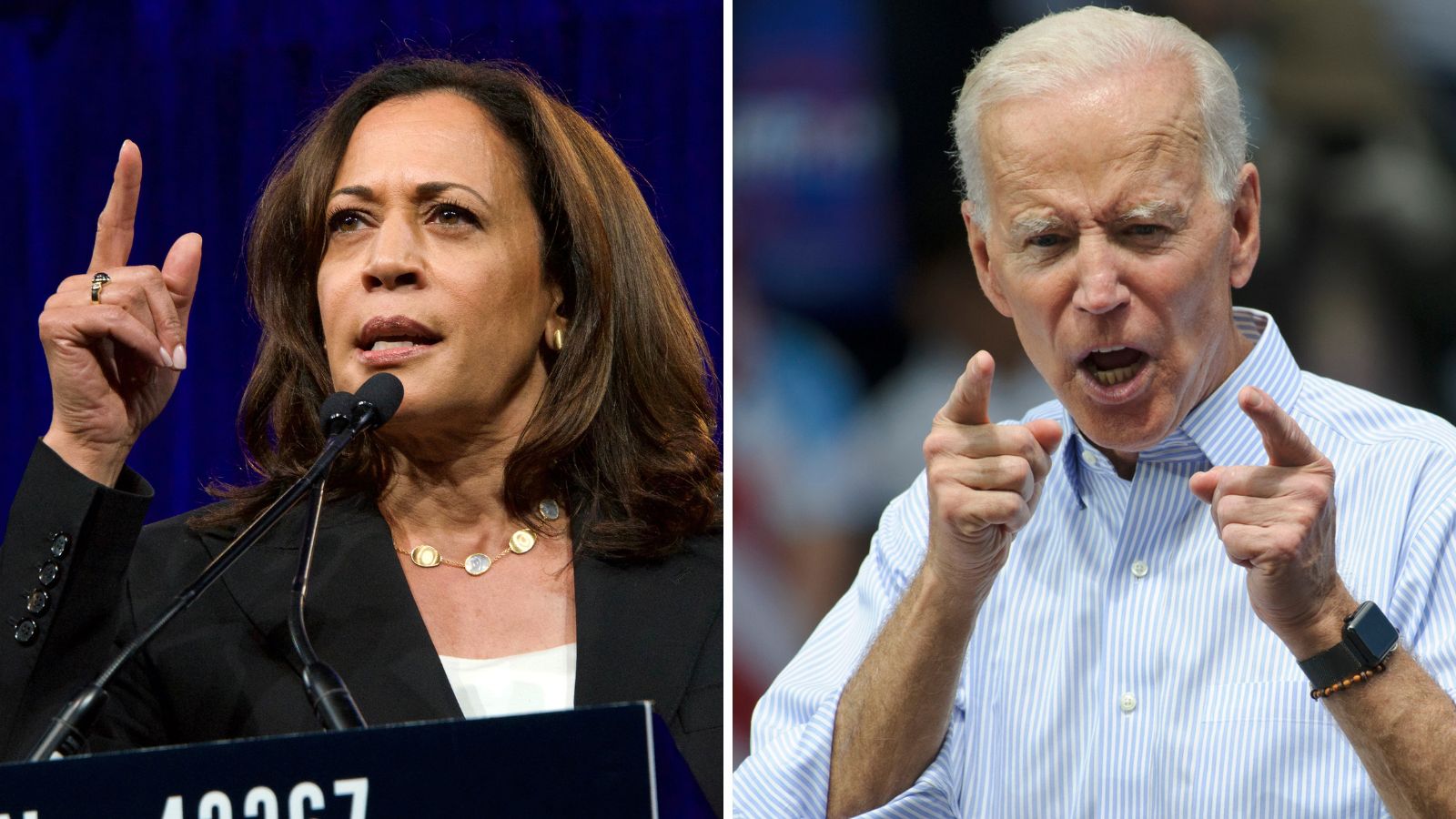

“Reverse Racism Doesn’t Exist, Idiot”: Biden’s Praise for Kamala Harris Raises Eyebrows

President Biden has claimed that Vice President Kamala Harris is fighting for freedom and that the Biden administration has rebuilt the economy. Understandably, his comments have left some people confused.

“Reverse Racism Doesn’t Exist, Idiot”: Biden’s Praise for Kamala Harris Raises Eyebrows

“I’d Like to See Him Pass a Polygraph”: Trump Fails at Basic Math and Rambles About Passing Meaningless Competency Test

According to NBC, Donald Trump has given a lengthy response to a question regarding age concerns. The former president and Republican presidential nominee candidate, who often says Biden is too old for his job at age 80, is 77.

“Seems Like Pure Racism”: House Approves Marjorie Taylor Greene’s Amendment to Cut the Secretary of Defense’s Pay to $1

The House has approved Marjorie Taylor Greene’s amendment to cut Secretary of Defense Lloyd Austin’s salary to $1.

“In the Far Future, White People Won’t Exist”: Biden Says White People Will Soon Be a Minority in America

President Joe Biden has boldly claimed that the United States will soon become “a minority-White European country.”